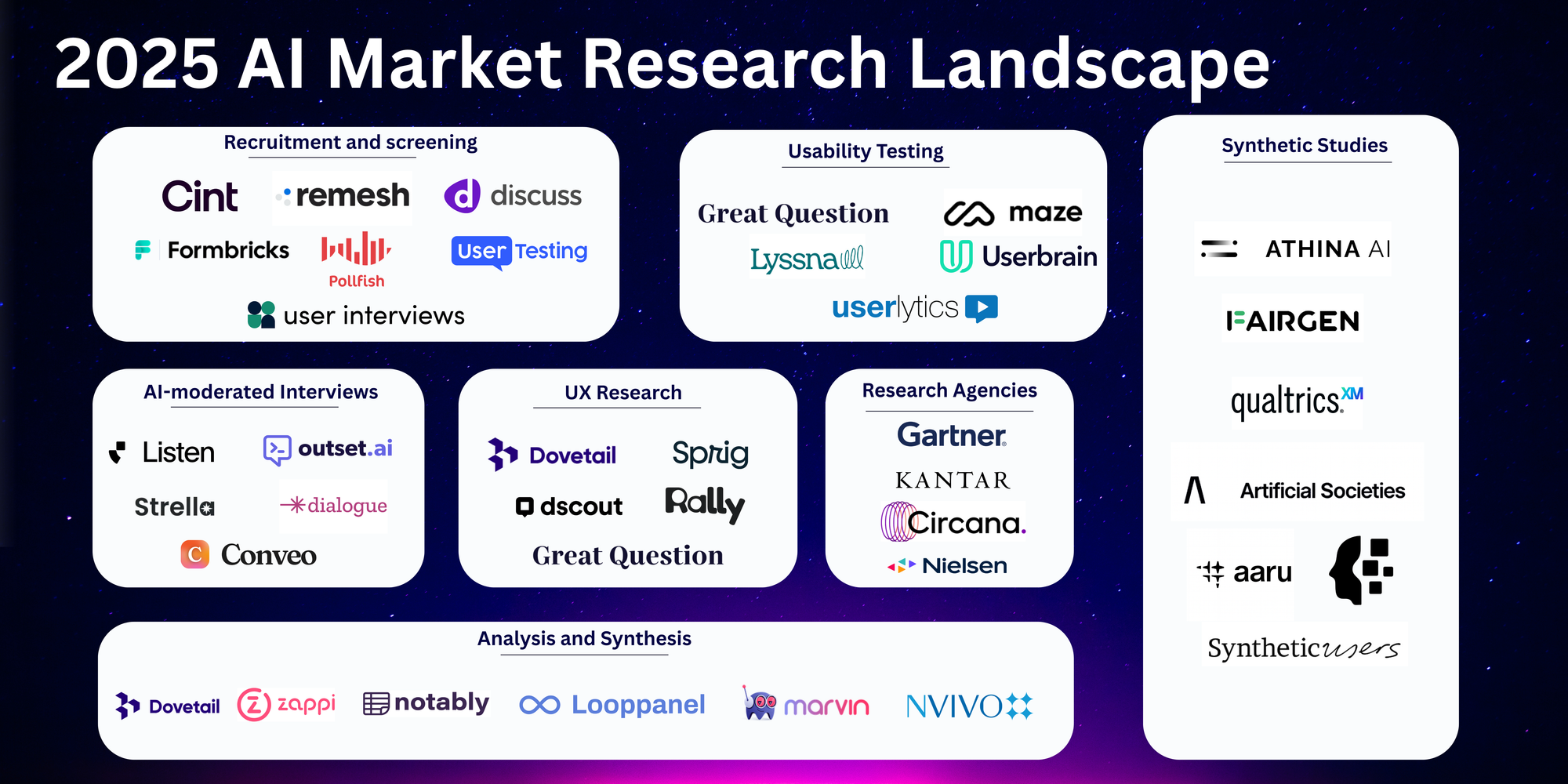

2025 AI Market Research Landscape: The New Stack for Consumer Insights

AI is quietly reshaping the way consumer and market research happens — from finding participants to synthesizing insights and even simulating audiences that don’t exist yet.

For CPG, retail, and consumer brands, research is no longer just about surveys and focus groups. It’s about connecting every part of the workflow — from recruitment to synthesis — into one intelligent ecosystem.

Below is a landscape of how research typically unfolds across eight key stages, and the AI-powered companies enabling each one.

1. Recruitment & Screening

This is where every study begins. Researchers define their target audience — maybe frequent snack buyers, or first-time luxury shoppers — and recruit participants who meet specific criteria. Screening questionnaires, scheduling, and incentive management take place here, ensuring quality and diversity in responses.

Companies to look for:

- UserInterviews — Access a large panel of vetted participants, complete with targeting and scheduling tools.

- Pollfish — Mobile-first platform that connects you to consumers worldwide for quick quant sampling.

- Cint — Global exchange linking brands to millions of verified survey respondents.

- Formbricks — Open-source feedback tool for running custom screeners or embedded surveys.

- Remesh — AI-driven platform that turns live group conversations into quantitative insights.

- UserTesting — Helps capture real user reactions and video feedback for product or ad testing.

- Discuss.io — Enables remote, moderated focus groups and in-depth interviews globally.

2. AI-Moderated Interviews

Once participants are recruited, the next step is conversation. Traditionally, this meant human moderators asking open-ended questions — but AI has entered the room.

AI-led interviewers now run structured conversations, probe deeper, transcribe instantly, and even generate first-draft summaries.

Companies to look for:

- Listen Labs — AI conducts and analyzes qualitative interviews end-to-end.

- Outset AI — Automates video-based interviews, probing and summarizing responses in real time.

- Strella — Runs multi-language consumer interviews at scale with AI synthesis.

- Dialogue AI — Conversational platform for conducting AI-moderated qual sessions.

- Conveo AI — Designs, moderates, and summarizes full interview workflows automatically.

3. UX Research

At this stage, researchers dig into how consumers actually use or experience products — digital or physical. From diary studies and in-app surveys to concept tests, teams capture real-world behavior and emotional context. It’s where discovery meets product development.

Companies to look for:

- Dovetail — Repository for storing and analyzing all research data across teams.

- Sprig — Runs in-product surveys and tests to capture user feedback in the moment.

- dscout — Mobile diary platform for observing consumers in natural environments.

- Great Question — Combines recruitment, scheduling, and analysis in one collaborative UX research hub.

4. Usability Testing

Here, teams observe how real people interact with prototypes, packaging, or interfaces. The focus is on identifying friction points, testing clarity of design, and measuring ease-of-use. AI helps scale these tests with automated recordings, heatmaps, and performance summaries.

Companies to look for:

- Great Question — Supports live and unmoderated usability sessions.

- Maze — Enables fast, unmoderated prototype testing with actionable metrics.

- Lyssna — Offers quick tests like five-second impressions and first-click studies.

- Userbrain — Subscription-based platform for ongoing usability testing with real users.

- Userlytics — Combines moderated and unmoderated usability testing across global audiences.

5. Analysis & Synthesis

After data collection comes the hardest part: making sense of it. This stage involves transcribing interviews, identifying themes, coding insights, and combining qual with quant. AI now automates much of this work — summarizing, clustering, and surfacing patterns across datasets.

Companies to look for:

- Dovetail — Transcribes, tags, and visualizes insights from multiple studies.

- Notably — Collaborative workspace for coding and synthesizing qualitative data.

- Looppanel — Automatically converts research calls into highlight clips and insights.

- HeyMarvin — AI assistant that turns transcripts into summaries and key themes.

- NVivo — Enterprise-grade tool for deep qualitative and mixed-methods analysis.

- Zappi — Automates creative and concept testing using benchmarks and predictive models.

6. Synthetic Audience

This is one of the most exciting shifts in research. Instead of always recruiting real people, teams can now simulate audiences that mirror target demographics, preferences, or behaviors. These synthetic cohorts are used for early testing of concepts, messaging, or UX before real-world validation.

Companies to look for:

- UserIntelligence - A simulation engine to generate directional insights, hypothesis and augment your real-world research.

- Artificial Societies — Simulates human-like agents to explore consumer behaviors at scale.

- Synthetic Users — Generates realistic user personas to test hypotheses instantly.

- Qualtrics Edge Audience — Uses modeled audience layers to extend traditional research panels.

- Aaru — Creates synthetic audiences for scenario testing and predictive analysis.

7. Research Agencies

Incumbents are still a trusted source for large-scale studies, specialized expertise, or complex methodologies. These firms manage everything from design to data delivery — often blending traditional methods with AI-assisted analysis.

Companies to look for:

- Nielsen — Long-time leader in consumer media, retail, and CPG measurement.

- Gartner — Advisory and insights firm offering market analysis and trend forecasting.

- Kantar — Full-service research agency with deep expertise in brand and shopper insights.

- Circana — Combines POS and panel data to deliver detailed retail and CPG analytics.

Final Thoughts

Across this landscape, AI is not replacing researchers — it’s extending their reach.

Tasks that once took weeks (recruiting, moderating, coding) now take hours. The result: more time for interpretation, storytelling, and strategy.

Whether you’re a CPG insights leader or a retail researcher, the new opportunity lies in stitching these tools together — creating a research stack that’s always learning, always listening, and always closer to the consumer.